How does a 2-1 buydown work?

A 2-1 buydown loan is a mortgage with a reduced payment for the first two years of the loan, and then the third year of the loan, the payment will rise to its note rate. So basically, you get a lower mortgage payment in the first two years of your loan.

Why are we seeing 2-1 buydown loans now?

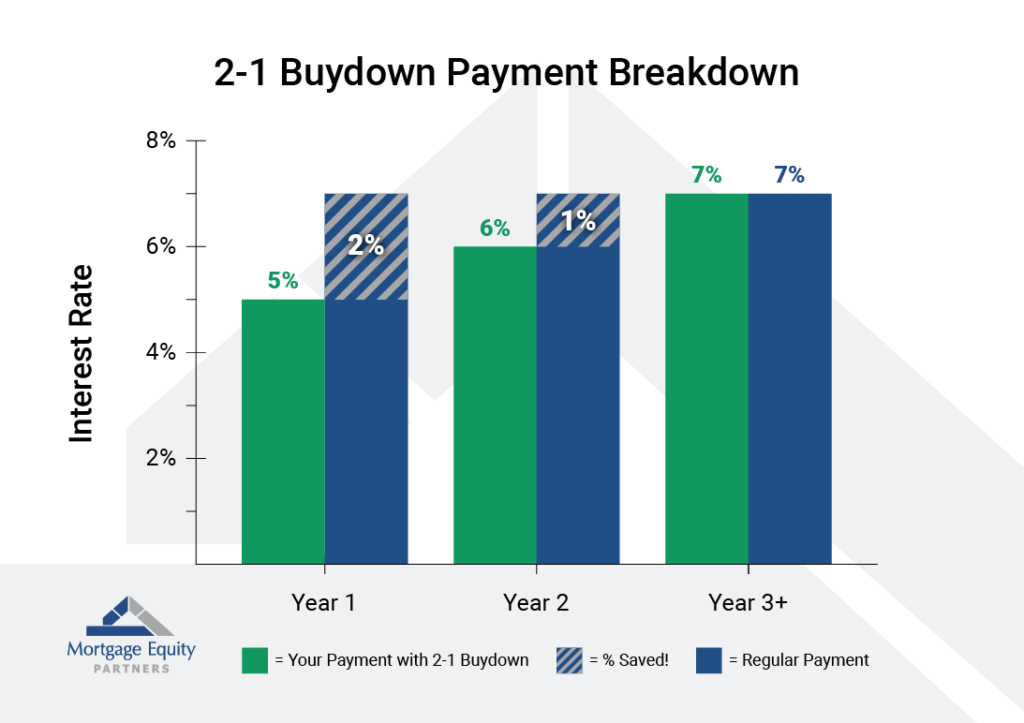

2-1 buydowns are becoming more popular as a solution to address the challenges posed by rising mortgage rates, particularly in a housing market where affordability is a growing concern. A 2-1 buydown is a temporary mortgage financing arrangement where the borrower’s interest rate is reduced by 2% in the first year and by 1% in the second year before reverting to the original rate for the remainder of the loan term. This structure helps to lower monthly payments for the first few years, making homeownership more accessible to buyers who may be struggling with higher rates. In a climate where mortgage rates have been elevated, a 2-1 buydown offers an attractive option for potential homeowners to ease into their mortgage payments while they adjust to the financial burden.

Another factor driving the popularity of 2-1 buydowns is their appeal to both buyers and sellers. For buyers, the temporary reduction in interest rates can significantly reduce the upfront cost of buying a home. For sellers, offering a 2-1 buydown can make their property more appealing in a competitive market, particularly when mortgage rates may be deterring buyers. The strategy can help sellers close deals more quickly by reducing buyer hesitancy, offering a way to make the property more affordable without permanently reducing the sale price. As interest rates remain unpredictable and affordability continues to be a key concern, 2-1 buydowns are emerging as a valuable tool to facilitate homeownership and real estate transactions.

In 2022 as property values continue to rise, sellers do not need to offer many incentives due to a lack of inventory. Still, buyers see the opportunity to make their monthly payments more affordable and are taking advantage of the buydown option. For example, most of the 2/1 buydown loans at Mortgage Equity Partners are financed by homebuyers. The funds to reduce the payments are deposited in an escrow account and made on behalf of the borrower. So in effect, a portion of the payment gets prepaid at closing.

“We took advantage of the 2-1 buydown program at Mortgage Equity Partners. We had been looking for a home for a while, and our loan officer told us we could reduce our monthly payments for the first two years with the buydown program. It works for us because we both expect to make more money in the next two years, so we aren’t concerned about the payment rising in the third year.”

~ George and Kayla Peterson, MEP First Time Homebuyers

Here is how it works:

This example is based on the current 30-year fixed-rate mortgage with an interest rate of 7%.

A 2-1 buydown is a simple fixed-rate mortgage where a portion of the payment is prepaid over two years.

Who is the best borrower for a 2-1 buydown loan?

- A borrower whose income could increase within two years

- A borrower whose spouse or partner will return to work in the next two years

- A borrower who wants to reduce the cost of their monthly payment for the first two years of homeownership to pay for upgrades or repairs

- A borrower who wants a low initial payment but doesn’t want an adjustable-rate mortgage

How do I qualify for a 2-1 buydown loan?

A borrower must qualify for the loan at the current mortgage rate. For example, if you are getting a 30-year fixed-rate loan and the rate is 7%, then you must also be able to qualify for the loan at that rate. In addition, your DTI or debt-to-income ratio must not exceed that required to qualify for the loan.

The 2-1 buydown loan is an excellent tool for first-time homebuyers and others to use as they adjust to making a mortgage payment. With the savings, they can make repairs and upgrades to their home or put the savings away to prepare for the higher rate to come. So if you want to buy a home now and need a solution to lower your monthly payments, a 2-1 buydown could be for you!

To learn more about this loan program and if you qualify, fill out the form or contact one of our knowledgeable loan officers!