Florida Hometown Heroes DPA funds have depleted for 2024 but MEP Advantage DPA is still live.

Fill out the form to see if you qualify or contact one of our qualified loan officers to learn more!

Update: No funds remain for Florida Hometown Heroes DPA

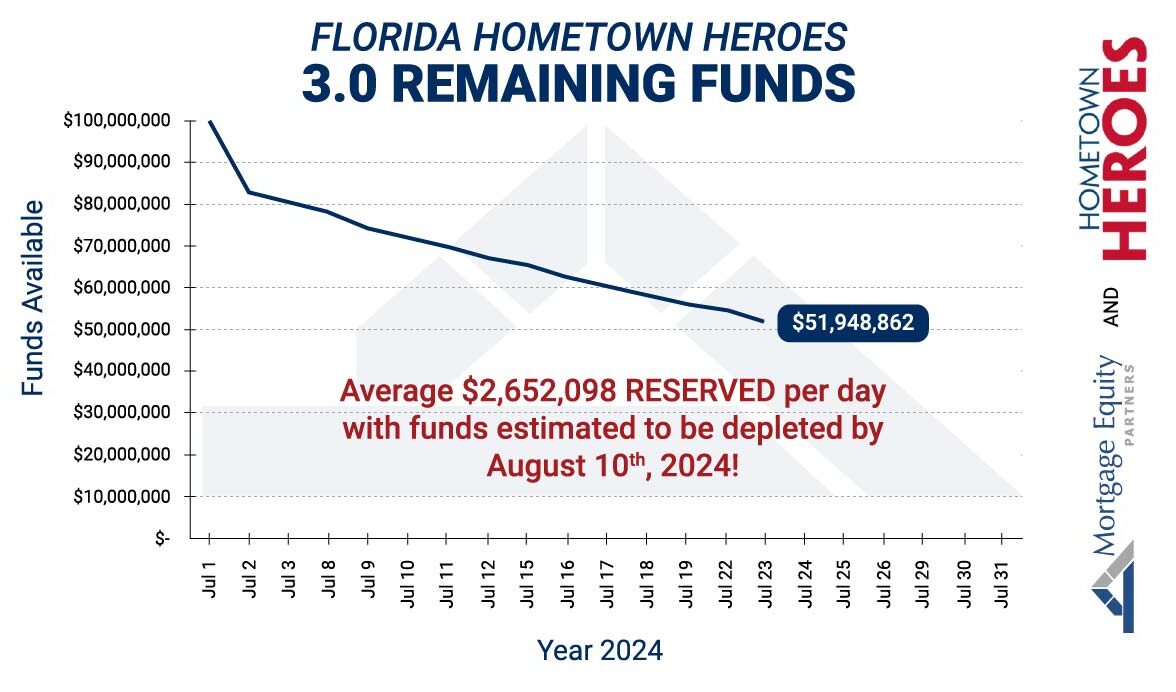

Starting on July 1, 2024, the Florida Hometown Heroes (HTH) Housing Program released a significant boost that local workers in Florida won’t want to miss. The additional $100 million in funding this program received will allow aspiring Florida first-time homebuyers to apply for down payment assistance. With rising housing prices, the down payment amount required to purchase a new home is also increasing. Due to this increase, many Floridians are getting priced out of the market. The Florida Hometown Heroes Down Payment Assistance program will make the dream of homeownership for local Florida workers more accessible, with up to $35,000 to use towards down payment and closing costs.

The 2024 funds are gone, BUT learn more about our own MEP Advantage DPA Program. Contact our Florida Housing-approved loan team to check eligibility and get pre-approved.

Who is eligible for Florida Hometown Heroes DPA?

The Florida Hometown Heroes Housing Program was initially designed with Florida’s frontline heroes in mind—law enforcement officers, firefighters, educators, healthcare professionals, childcare staff, active military members, and veterans. Now, Florida Housing and Governor DeSantis recognize that all full-time workers in Florida play a role in shaping our communities and making Florida a fantastic place to live and work.

Starting July 1, eligibility is broadening. Now, if you work full-time (35+ hours per week) for any business in Florida and meet income eligibility and program requirements, you could qualify for this incredible opportunity. That’s right, the program is moving away from career-specific eligibility to focus on income, making more first-time homebuyers than ever eligible for down payment assistance. Any income-eligible first-time homebuyer in Florida who meets the program requirements is invited to apply.

How do I qualify for Florida Hometown Heroes DPA?

Are you concerned about whether your employment qualifies? You are eligible if you’re employed by a business with a physical presence in Florida—like Mortgage Equity Partners, which has offices here but is headquartered out of state.

Program Highlights:

- Eligibility for lower-than-market rates on FHA, VA, USDA/RD, Fannie Mae, or Freddie Mac First Mortgages.

- Down payment and closing cost assistance up to 5% of your first mortgage loan amount, maxing out at $35,000.

- Assistance is provided as a 0%, non-amortizing, 30-year deferred second mortgage, which is repayable upon selling the property, refinancing the first mortgage, transferring the deed, or if the property is no longer your primary residence. Note that this loan is not forgivable.

To be eligible for Florida Hometown Heroes DPA:

- You must be a first-time homebuyer, which means no homeownership in the previous three years.

- Your income must not exceed 150% of your county’s Area Median Income (AMI), and your loan must meet your county’s loan limit requirements.

- Refinance transactions are not eligible for the FL Hometown Heroes Program.

- Borrowers must take an approved HUD homebuyer education course.

- Single-family residences, townhomes, and FHA-approved condo purchase transactions are eligible.

- Lot and land loans are not eligible for this program.

Thanks to Governor Ron DeSantis, these funds are set to make a real impact for first-time homebuyers in Florida—but they won’t last forever. Planning is key. Reach out to an MEP loan officer today to find out how you can make the most of the new funds received for The Florida Hometown Heroes. Don’t miss your chance to realize your homeownership dreams. Act now and take the first step towards your new home in the Sunshine State.